Cash Automation

The impact of cash recycling on branch operations

This report is based on the analysis of daily vault buy and vault sell data from 10 bank and credit union branches.

Observations/findings

Banks and credit unions provide a high level of service to their members. Branches can be quite busy and a complex mix of transactions is usually present, both at teller windows and drive up windows. The challenge of efficiently controlling the significant cash inventories and transactional cash flow using existing staffing models is normally cited by branch staff as the primary opportunity for improvement.

Branches implemented a number of strategies for minimizing the number of dual-control processes in use, but analysis shows that the use of teller cash recyclers (TCRs) either as a vault, or on the teller line replacing cash drawers, will:

- dramatically improve the level of control and security of branch cash,

- lower the total cash inventories in branches,

- eliminate significant amounts of wasted non-value work by tellers,

- increase the transactional throughput of each teller position,

- and allow Branch Managers and Head Tellers to perform higher value work by eliminating many of the custodial dual control activities they perform every day.

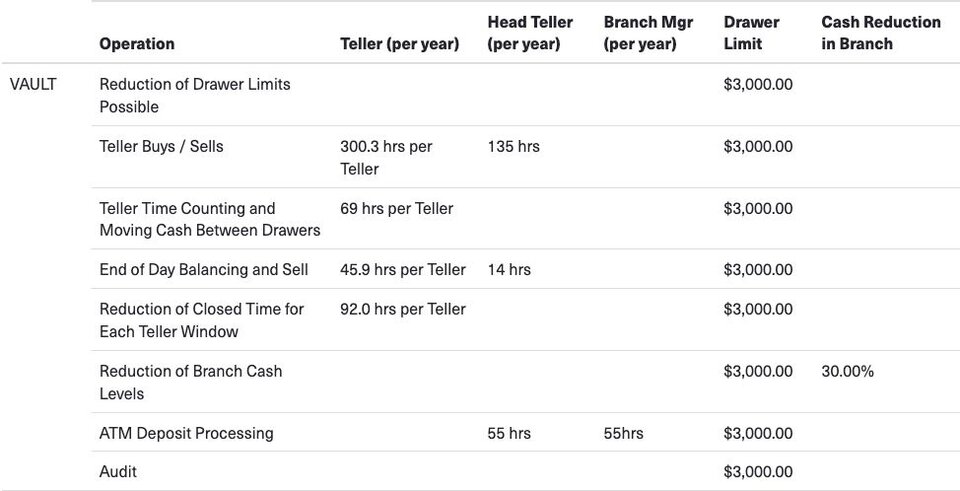

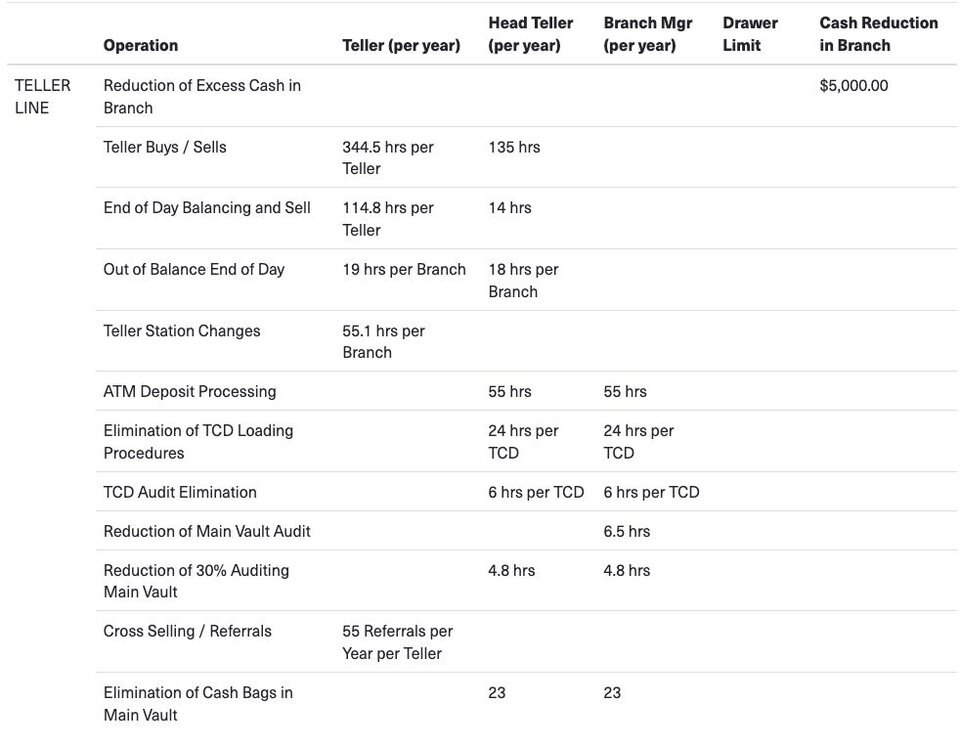

By automating the deposit, validation, denominational sorting, storage and dispensing of cash with a cash recycler, significant savings in both time and money can be realized. The table below shows a summary of the hard savings and is explained in detail throughout the full version of this report.

Conclusions

Current state

Tellers at both the drive-up window and at the main teller counter provide an exceptionally high level of service to members. There are many opportunities for product and service referrals, but the current staffing model and cash-control processes often requires members to wait in lines and tellers to spend a large portion of their time counting cash in front of members. Many of the transactions conducted at the teller window could be completed online if tellers had time to train members (i.e. balance inquiries, check reconciliation, simple account transfers).

Areas of improvement

The branches we visited were extremely busy and had a constant line of members waiting to be served. Transactional velocity is an issue when members are waiting. Many of the transactions that take the longest have little value for the bank. Cross-selling is difficult due to the need to make transactions more efficient.

Opportunities – Vault

Tellers would spend less time counting, verifying, buying and selling cash. They would not be strapping, sorting and verifying cash. Instead, that time could be spent with an open teller window serving members. Tellers would be able to increase the accuracy and efficiency of all large cash transactions by having access to the recycler for immediate automated verification.

Opportunities – Teller line

The use of teller cash recyclers on the teller line would give tellers significantly more time to engage members (during the time a teller would normally be counting cash). Cross-selling, referral and member-education by tellers could significantly increase revenue and lower branch traffic for low-value transactions.

ROI calculation – Vault

Reduction of closed time for each teller window. Estimated improvement:

(20 mins. per day) x (# of tellers) which will increase customer throughput and lower the cost of each transaction.

- 20 mins / teller / day

- 86.7 hrs / teller / year

Reduction of counting and sorting for large transactions would further reduce the closed time for each window.

ROI calculation – Teller line

Soft benefit: Cross-selling/Referrals – It is conservative to assume that the use of the CM18 recycler, either as a vault or on the teller line, will free the teller to refer at least one additional member each day:

(# of tellers) x (1 additional referral per week) x (value of 1 referral)

- 1 referral / teller / week

- 52 referrals / teller / year

Sesami Solution Experts

The team at Sesami.io consists of innovative and skilled professionals with deep expertise in industry trends and technical knowledge. They have a proven track record of guiding businesses through numerous technology cycles, especially in the retail and financial sectors. Their work involves creating cutting-edge solutions that set new standards for how companies leverage digital technology. Renowned for their analytical skills and strategic insights, the team has led numerous transformative projects, positioning themselves as key influencers in the technology field. Their unwavering commitment to excellence and their drive to expand the possibilities of technology makes them trusted partners in managing the complexities of today's digital world.