Cash in the Evolving Branch

Discover how cash remains relevant in evolving bank branches. Learn about trends in cash automation, operational efficiency, and the role of cash recyclers in modern financial institutions.

What is a Cash Recycler ?

A cash recycler is a complex machine that automates a couple of simple, but important tasks—accepting and dispensing cash. It also stores cash securely at the point of use and keeps an accurate accounting of its inventory and transactions. Generally, you’ll find these devices in banks, credit unions and back-office retail cash rooms.

In a cash recycler, banknotes are placed into a feeder then passed through a bill identifier to determine the denomination and validity of the notes.

The banknotes then enter a secure safe enclosure where they enter separate storage modules based on their denomination until they are dispensed in a future transaction.

So, it’s the very definition of recycling, the cash that is deposited to a recycler is the same cash dispensed from it for later use.

What Can Cash Recyclers Do For My Institution?

As branches evolve, many institutions are asking how cash recyclers can support efficiency, security, and cost savings. This section answers key questions to help you understand their full value.

Is My Financial Institution a Candidate for Cash Recycling?

Answer is: it depends.

Without question, there are no two organizations exactly alike; for that matter, there are no two branches exactly alike. Determining whethe or not your organization will benefit from teller cash recycling is all about understanding your data and branch objectives.

When implemented appropriately, cash recycling improves operational efficiency and customer engagement while reducing labor and othe costs associated with cash management. But to ensure successful implementation, it is imperative to review your organizational goals, branch characteristics and re-engineer your branch processes.

Identifying the exact solution takes significant analysis, but there are a few basic questions you can use as a litmus test to determine if cash recycling is right for you.

- Are you currently working to lower the operating costs of your branches - specifically labor costs?

- Have you or do you plan to implement the “universal banker” model - one where all branch employees can fill a variety of value-added roles?

- Is branch remodeling or renovation currently being considered?

- Are you looking to develop a sales-focused culture in your branches in an effort to grow your business?

- Are you interested in installing new technology that tightens cash control and enhances the security of cash storage?

Chances are, if you’ve answered yes to any of these questions, you need to explore the potential benefits of teller cash recyclers for you financial institution.

How Will Cash Recyclers Impact My Role in the Branch?

From the corporate office to the teller line, the value you see from cash recycling often depends on your role in the organization.

CEO / President

You’re charged with maximizing shareholder value, developing a strong and supportive employee culture and delivering best-in-class service to your customers. In as much as recyclers lower labor costs, improve teller efficiency and security, and focus staff on serving customers rather than managing transactions, they appeal broadly to chief executives.

COO

You are responsible for strategic planning and delivery of technology and operations across your bank network. You analyze systems and processes to develop an efficient operating model. While you appreciate the security and financial benefits of recyclers, for you, they represent flexibility to change the branch environment.

By securing cash at the point of use, they allow you to implement teller pod and other open concept designs as well as innovative operating models such as universal teller, concierge and mobile teller.

Shifting focus from cash to the customer is essential in creating a warm branch environment.

CFO

Your job is to oversee the financial operation of the bank. Foundational benefits of cash recycling include centralized visibility of branch cash inventory and an overall reduction of cash on hand through more intelligent cash management.

By reducing the amount of cash in branches, you’re able to convert a nonperforming asset into an asset that yields a return.

The Branch Manager

You wear many hats. You lead your team, serve as the first level of client escalation and advocate your brand in the community.

Teller cash recyclers allow your team to focus more on problem solving and meeting the financial services needs of your customers rather than just counting cash and overseeing transactions.

More productive, happier branch staff will deliver better service to your customers or members.

The Head Teller

The head teller is the person responsible for making sure the teller line runs smoothly, accurately and in accordance with corporate policies and procedures all while delivering superior service to customers.

For a head teller, cash recyclers mean the teller line handles fewer notes, balances in a fraction of the time, and can turn attention to value-added customer experiences without putting accuracy or policy adherence at risk.

The Teller

As the front line or face of the brand, tellers deal with customers who expect professionalism and consideration.

You know what it means to work in a high stress environment where you must adhere to a broad set of policies and procedures while quickly and accurately handling tens of thousands if not hundreds of thousands of dollars.

Teller cash recyclers automatically verify, count, sort, store and balance cash so you can focus more on delivering the personal service only you can provide.

How Do Cash Recycler Impact Branch Revenues?

Can a cash recycler directly increase branch revenue? Is cash automation a revenue generator? In short, yes, but it really depends upon your infrastructure and staff training.

Cross-Selling Is More Than a Buzzword—Here’s Why

By eliminating the mind-numbing task of counting money, your tellers now have time for quality conversation with your customers.

Time to build relationships, to find out what customers’ needs are and focus on which products and services will help them meet those needs. Building revenue through cross selling is the low-hanging fruit of cash automation.

Do it well and the results can be staggering.

But cross selling can present some challenges since staff isn’t always ready for this change. Many times, tellers were hired for one skill – their ability to count cash accurately. These days, tellers must also be salespeople.

Some Tellers Sell Naturally—Others Need Coaching

Training goes a long way, but in the future, human resources will need to reassess the skills and traits for teller positions. So while cash automation can free tellers’ time, they need to be able to effectively use that time with the customer.

How Do Cash Recyclers Optimize Staffing?

This is a polite way of asking, ‘Can I eliminate a teller position?’ The short answer is maybe.

Research suggests that with a cash recycler, two employees can do the work of three. In traditional branch environments, constraints like peak-hours staffing needs and time-consuming activities like vault buys, limit the ability to schedule teller shifts efficiently. Automating cash processes is a good way to alleviate those constraints. But, this brings up a more complex question.

Can you use cash automation to reduce staff?

The answer is yes, you can but whether you should is a better question.

Repurposing — rather than eliminating — staff might be the answer. When you retain experienced employees, moving them into different roles, you can add value to other areas of the branch.

Perhaps a teller can be cross-trained as a loan officer to help alleviate logjams during peak hours. Maybe a vault teller is more available to jump on the teller line during peak hours or act as greeter when it’s slower.

The possibilities are endless and the right answer probably depends on the needs and goals of each branch and its customer base.

How Do Cash Recyclers Enhance the Customer Experience?

So far, the focus has been how cash automation improves the staff experience but does it improve the customer experience? Let’s look at the difference.

The teller is no longer intently concentrating on counting a pile of cash so there’s opportunity for eye contact and conversation.

Focus has shifted from the transaction to the customer.

Tellers have the opportunity to get to know customers, show interest in their financial wellbeing and build long-term banking relationships. Consistent transaction convenience and accuracy builds trust and customers find a resource for their financial questions and concerns.

Customers are sure to notice significantly shorter transaction times.

By studying transaction lengths at thousands of branches around the country, research shows the following:

Average Consumer Transaction Time

Traditional Avg: 120 seconds

Automated Avg: 30-35 seconds

Avg. Commercial Transaction Time

Traditional Avg: 5-7 minutes

Automated Avg: 1-2 minutes

75%-80% IN TIME SAVINGS

As you can imagine, these numbers can vary depending on branch location and customer mix. But more important than shorter transaction times is the fundamental shift in focus from the cash to the customer.

So those seconds become precious time tellers can spend completely engaged with customers, building rapport and discussing additional products and services.

It suggests an overarching theme for automated branches, a customer experience that is quicker, more personal, and more substantive.

What is the Return on Investment (ROI) of a Cash Recycler?

- A cash recycler is a large purchase and you will need to justify the expense.

- While there are many factors in ROI calculation, you can generally see a return on investment in as little as in 12-18 months.

- Each branch is different, and a comprehensive ROI cannot be truly calculated until an in-depth branch analysis is performed.

- On a side note, factoring depreciation into the formula is an often overlooked part of the equation that can improve ROI dramatically.

SESAMI INSIGHT INTERVIEW

Interview with DBSI: Bank Design – Past Lessons and Future Possibilities

The bank branch is undergoing a metamorphosis. Mobile banking is well-established, in-branch transactions are declining yet banks still face pressure to develop additional revenue. Branches have been forced to adapt—and quickly.

For more than 20 years, DBSI has been instrumental in helping countless financial institutions modernize their branch networks. The Executive Chairman at DBSI, John W. Smith, has an interesting and thought-provoking perspective where retail banking has been and the direction it's headed.

Q: You’re on the cutting edge of retail banking design. What do you see?

A: I think branch transformation is the priority. Why?

Because 65% of a financial institution’s costs are tied to their physical footprint—branches and ATMs. If you don’t optimize this channel, those costs can become a serious liability.

Look across other retail sectors—hotels, quick-service restaurants, airlines, pharmaceuticals. Most of them saw the need for change long ago and acted accordingly. They optimized, enhanced, and evolved.

Now, financial institutions are catching up and applying those same principles. What does that look like?

Stores that advise, educate, and help customers onboard into more convenient banking methods. Stores that deliver a truly differentiated experience.

And all of this—at a lower cost.

A natural extension of that transformation is micro-branches and shared tenancy. Think smaller. Think closer to the customer. Tap into existing foot traffic by locating near retailers already drawing crowds. That proximity drives engagement—often at 25% to 50% less cost.

Q. What are three ways that banks can bring customers back into the branch?

A: One is “Let them know you exist.”

There are more than a million retail stores in America. When visitors come to our ideation center, I always ask them, “What retailer or retailers stand out to you when you’re driving to work, heading home, or just moving around the city?” And there's always a pause.

They scratch their heads—no one can name more than two. Seriously, never more than two.

And it's usually a variation of the same two. Out of over a million stores, most people can’t name even two that truly stand out with curb appeal or market themselves 24/7. So, you’ve got to be able to sell your curb appeal—your store—around the clock.

Number two: Let them test drive.

Take Apple stores, for example. Everyone brings up Apple, and who wouldn’t? They’re wildly successful; their profit per square foot is higher than any retailer in America.

But what are consumers doing in an Apple store?

They’re not just picking up boxes or reading labels. They’re interacting with the products—testing them out.

It’s the ultimate test drive. They’re assessing how a product fits their needs and experiencing its ease of use. If they have a question, someone is right there to assist. That "test drive" experience is key—and pretty powerful.

Number three: Give them value.

Consumer needs are obvious. Just look at the numbers: savings rates are alarmingly low, and debt levels are high. There’s a clear demand for sound financial advice.

Banks can—and should—support their clients through life’s financial journey. They need to connect the dots between customer needs and the right solutions, and then execute clearly. It’s fuzzy right now. So, let them know you exist, allow them to test drive, and genuinely deliver value.

Q: You’ve spent a lot of time in the banking industry with a focus on technology. How has technology changed the way branches are designed?

A: I speak from a fairly deep background in this—both in the U.S. and internationally.

Historically, whether in America or abroad, branches were primarily designed to protect the bank’s main asset: cash.

That focus led to poor service environments—physical barriers, limited interaction, and generally inefficient branch layouts.

Then came the cash recycler—in my view, one of the simplest and smartest investments a financial institution can make.

It secures the cash, offering vault-like protection right on the branch floor. But more importantly, it frees up the space—transforming the branch into a more open, retail-like environment that's focused on service.

It shifts the staff’s attention from handling cash and performing routine transactions to addressing customer needs. And it eliminates common pain points like out-of-balance conditions.

Ultimately, it enables branch teams to focus on what matters most to the institution: delivering strong service and engaging in needs-based selling.

Q: Is there a place in retail banking for both assisted self-service machines and cash recyclers?

A: Absolutely—this can be a transition strategy, or it can be a combination of both.

Banks have the flexibility to choose one or integrate both, depending on the kind of branch experience they want to deliver.

At a minimum, two key elements must be considered:

- First, it's more than just installing the right technology. Far too often, institutions assume that simply placing new tech on the floor will magically improve the customer experience. But that’s rarely the case. The right process must support the technology, and the messaging must clearly communicate why the solution is valuable—for both the customer and the staff.

- Second, institutions need to carefully design the transition journey. For example, if a customer begins a transaction at a self-service station but needs assistance opening a money market account, how do you seamlessly guide them to a banker? What does that journey look like?

Likewise, for the institution, the transition might involve starting with one device and planning how to scale or upgrade to the next generation of that technology at a low cost.

Starting with cash recyclers makes perfect sense—they enable secure, full-service banking with greater efficiency. But if the goal is to reduce costs and shift customers toward self-service—while retaining a human, assisted experience—it’s critical to get the process right and ensure staff are well-trained.

So yes, assisted self-service machines and cash recyclers can and should coexist in a well-designed branch strategy.

Thinking Of Cash Recyclers – How?

Do I Need to Change My Teller Line? You’ve researched, talked to peers and heard enough success stories to be convinced in moving forward with cash recyclers in your branches. Now what ?

- What type of modifications will be needed on the teller line to prepare for this new direction?

- Will the deployment of this technology accompany a branch redesign or renovation?

- Will the existing teller counter need to be raised or retrofitted to make room for this new device?

- What will all of this added construction add to the total project costs?

These are all very common questions and concerns. And the answers will be based on the scale of your project and the cash recycler model you choose.

Designed to Fit: Recyclers That Work with Existing Teller Lines

Some models are even the same size and footprint of a standard teller cash drawer allowing you to replace the under counter steel with a recycler in a retrofit application so you can be up and running quickly. Or you may be considering a branch redesign or planning a new branch.

In this case, you may not be constrained by existing infrastructure but you must still consider your space requirements when researching individual machines.

Making the decision to explore cash automation in the branch often creates more questions than answers. But by digging into your internal processes, you can usually find inefficiencies worth addressing, and cash automation can be part of the solution.

The Role of Placement and Ergonomics in Cash Recycler Integration

As more banks embrace cash automation, a key question emerges: should you retrofit your existing teller line or invest in a full branch redesign? The answer depends on your goals, space constraints, and the type of recycler you choose.

Redesign or Retrofit?

Open concept branches, sometimes called “pod” designs, deconstruct the teller line and locate bank staff at small workstations placed throughout the space.

So instead of being served from a tall counter at a traditional teller line, customers interact with an associate at a standalone pod or seated desk. This eliminates several barriers to client service and facilitates conversations. These dialogues can lead to more sales and customers who feel more a part of the banking experience.

Cash Recyclers Power the New Branch Experience

The recyclers secure currency at each of the stations, creating a safer environment for employees and customers. Having cash recyclers to accurately execute transactions and secure cash in an open area is a critical component of successful open concept branch design.

Without their security, speed, accuracy and the ability to keep a transaction record for individual operators, executing an open concept branch would be nearly impossible.

An open branch environment helps staff engage more proactively with customers and creates a more retail like experience. And cash recyclers are a foundational element of an open concept branch operating model.

Secure Cash, Rethink the Teller Line

Typically front line employees have these basic responsibilities: conduct transactions efficiently and accurately, make sure the client experience is great, and cross-sell products.

Implementing cash recyclers as part of an open concept addresses many of these issues. By ensuring transactions are completed quickly and precisely, bank staff can spend more time talking with customers and listening to their needs. This presents the opportunity to sell products and services.

Fitting Cash Recyclers Into Your Space: How Much Room Do You Really Need?

Integrating cash recyclers into your branch layout isn’t just about choosing the right device—it’s about placing it strategically to support both workflow and customer service. While many models are compact enough to fit under standard teller counters, some require more thoughtful space planning.

Knowing the space requirements early in the process will help you select the optimal locations for your recyclers and allow you to plan for any alterations needed to accommodate them.

Prioritize Accessibility for All Operators

A recycler should be located where it is accessible to all potential operators. A typical placement is underneath a desk or counter with access for two operators. All operators should have access to cash input and output areas as well as display screens.

Plan for Service Clearance and Access

It’s important to consider the recommended service clearance footprint for any recycler model. Service clearance requirements account for measurements such as the space needed for the safe door to swing completely open or how much unobstructed space is required where racks or drawers need to be fully extended.

A technician should also be able to access any rear panels from at least one side of the unit. You don’t want to restrict service access and incur increased service time and costs.

Don’t Overlook Floor Load Capacity

Also important to consider is whether the floor at the installation site can support the weight of a device fully loaded with currency. Review technical specs for the maximum weight and surface load for a particular model so you can verify that your floor will support it. This is especially important if you are installing a recycler in an old or historic building or a floor above ground level.

Cash Recyclers & The Economics of Ergonomics

Often overlooked, ergonomics plays a critical role in the cash recycler selection process—impacting both efficiency and employee well-being.

On any given day, a teller will spend eight or more hours at a desk or window assisting customers. Whether it’s the repetitive motion of counting cash or repeatedly stretching for a cash drawer that is a little out of reach, there are multiple ways a repetitive motion injury could occur.

To prevent repetitive motion injury, you should be able to execute repeated physical movements with efficiency and ease.

Repetitive Motion Disorders are caused by too many uninterrupted repetitions of an activity or motion or unnatural or awkward motions.

A cash recycler solves many of these teller line overuse issues, but it’s also important to ensure that the machine doesn’t create complications. With a little foresight and planning, many overuse injuries can be prevented.

- Where will the machine be located? Is the feeder and output in an optimum spot?

- Will reaching for cash cause undue stress on the back?

According to Ergonomics Plus, there are five proven benefits of a strong ergonomics process at the workplace:

- Reduce costs – Approximately $1 of every $3 in workers compensation costs can be attributed to RMDs.

- Improve productivity – The best ergonomic solutions will often help employees to be more productive. Ergonomics improves quality.

- Improve quality of life and performance – Employees can become frustrated or fatigued due to poor ergonomics which impacts the quality of their work.

- Improve employee engagement – If an employee is free from discomfort during their workday, there is less absenteeism and turnover, as well as an increase in employee involvement.

- Create a better safety culture – Making a commitment to employee health shows your employees that you care.

Consider the Five Operator-Machine Interaction Zones:

A. Zone covered only by visual field.

B. Visual field with neck rotation.

C. Visual field with neck and shoulder rotation.

D. Visual field with neck and whole body rotation.

E. Visual field with neck and whole body rotation and whole body movement.

Coin or No Coin?

You understand the benefits of cash recyclers but what about coin dispensers? In the same way a cash recycler dispenses banknotes for a cash-out transaction, a coin dispenser dispenses loose coins for the same transaction.

A coin dispenser alongside a cash recycler shortens transaction and wait times, allows more face time, and improves accuracy for coin-out transactions just like a recycler does for banknotes.

What to Look for in Cash Recycler Hardware

Note Capacity – How Much Is Enough? When choosing a cash recycler, financial institutions and retailers must carefully assess note capacity to ensure it aligns with their transaction volume, staffing model, and overall branch or store operations.

Inadequate capacity results in workarounds that erode efficiency gains at the heart of cash recycler ROI. Surplus capacity encourages staff to retain too much of a non-performing asset.

So what is the right capacity? Again, it depends.

Understanding Local Cash Needs and Manual Processes

Understanding cash volumes at the local level as well as the manual processes surrounding cash in the branch is key to determining the note capacity you need.

Sole control custody, segregated storage and dual control cash replenishment procedures are just a few of the manual processes that limit the ability to accurately manage inventory requirements.

In an attempt to control shrink and limit theft, these manual processes sacrifice inventory control for accountability. Once the limitations imposed by manual cash handling processes are fully understood, calculating the appropriate capacity for a cash recycler becomes far more academic.

The Real Goal: Optimize, Don’t Maximize

The adage “you can never have too much of a good thing” fails to ring true in the case of cash on hand and cash recycler capacity. The goal of recycling isn’t to store as much cash as possible — it is to store only the cash you need and not a dollar more.

On average, financial institutions and retailers reduce average cash on hand by 25% - 40% after implementing recycler technology.

By storing currency centrally in a cash recycler with detailed electronic journal capabilities, businesses eliminate redundancy in denominational inventory without compromising audit and security.

Rolled Storage Modules vs. Stacked Cassettes: Which Fits Your Workflow Best?

Cash recycler models are based on one of two designs: Roll module (RM)/ Rolled storage module (RSM ) or traditional stacked cassettes.

- Stacked cassette technology was introduced in the 1970’s with the first ATMs. The fundamental design of box-like cassettes that open from the top as well as the picking technology used to retrieve notes from each cassette has remained largely unchanged

- RM/RSM technology was introduced in the 1990s, specifically to address problems with cassette-based technology including the notepicking errors that triggered frequent audits.

Stacked Cassettes

Stacked cassettes store banknotes like a traditional ATM cassette. The difference is that the cash recycler is both stacking the notes as they are processed through the unit and storing them for later retrieval.

The notes are stacked on top of each other from the bottom of the cassette to the top. When a withdrawal is in progress, notes are removed from the cassettes with friction-based picking, just like an ATM.

Key Advantages

- Typically faster deposit and withdrawal speeds

- Higher note capacity per cassette

- Sometimes the cassettes can interface with an ATM

- Fast manual cassette loading Stacked Cassettes

Key Disadvantages

- Limited denomination configuration with most limited to six cassettes and severely limiting the options for configuring denominations.

- Multi-picking errors are a byproduct of friction picking technology. Longer total transaction time due to jams and errors.

- An internal reject bin that results in balancing issues and triggers more frequent audits.

- Security. If the safe is opened, notes can be rapidly emptied from the cassette for a higher level of vulnerability during a robbery event.

- Different sized notes require manual hardware adjustments to the cassette and take the unit out of service.

- Requires notes in pristine condition to function well.

Rolled Storage Modules

Cash recyclers based on roll module (RM) design, also known as rolled storage module (RSM), store notes on roll drum modules.

One by one, notes roll onto the drum as they are deposited and roll off the drum as they're dispensed.

While on the drum, they are held in place by thin strips of clear Mylar, keeping tension at all times and ensuring they are separated to prohibit more than one note from exiting the cassette at a time.

Depending on the device model, notes are stored short-edge or long edge first on a drum.

Key Advantages

- More cassettes. Two RSMs fit in the same physical space as one stacked cassette. RSM-based recyclers typically have 8 to 12 RSMs and achieve nearly the capacity of cassette-based models when designating multiple RSMs for a single denomination.

- Flexible, tailored configuration. A higher number of storage modules allow the device to be tailored for the demands of each branch . So if 20s are the most popular banknote dispensed at your branch, you could assign three modules to that denomination.

- More compact. The total size of all RSMs is smaller than the total size of six stacked cassettes resulting in a more compact device that can be used in a wide variety of applications.

- Modular operation. Individual RSMs can be disabled without taking the entire device out of service. And if you have multiple cassettes of the same denomination, you’re still in business with that denomination.

- More secure. Notes cannot be added or easily removed manually. They must be processed through the device input and note reader to enter and exit the RSMs, creating an electronic transaction record and audit trail.

- No internal reject bin. Reduces balancing errors and audit frequency and insures all notes are accounted for.

- Higher note acceptance rates. Advanced reader technology tolerates a wide range of note fitness levels for fewer rejects.

- Faster Total Transaction Speed. Lower reject rates along with faster device response to teller commands results in in shorter overall transaction times.

Key Disadvantages

- Individual cassette capacity is lower

- If notes are stored on a cassette for too long there is the possibility of “cupping”. (More common with cassettes that store notes short-edge first, rather than long-edge.)

- More moving parts.

- Deposit and withdrawal speeds are normally slower than cassette-based models.

Transaction Speed – Is Faster Really Better?

A cash recycler’s speed of acceptance is important, but so is accuracy, length of bill path, simplicity and escrow design.

The banknote’s journey includes a pass through a reader module (to check for note authenticity), numerous changes of direction and a brief stop at escrow, before finally being deposited.

Bill Movement Must Be Smooth and Reliable

The device must be able to move a note through the bill path to the denomination cassette without causing a jam or miscount. Frequent jams and miscounts reduce overall transaction speed.

Reader modules vary wildly on the number of unique banknote characteristics they measure, which directly impacts speed and accuracy rates.

Shorter Bill Paths Are More Efficient

Long bill paths take more time and increase stoppage and error rates. Ideally, the bill path will be short with the note making a limited number of directional changes.

While there are some positives to physical escrow, it brings unneeded complexity to the bill path and it doubles the risk of errors because the entire process is repeated before the note is finally deposited.

Outbound Speed Can Slow Down the Process

Outbound speed is important when moving cash from the unit to the vault. In the United States, cash must be strapped, so a flow that supports strapping in 100-note increments is ideal. Notes piling up beyond 100 will overwhelm the teller, requiring a recount and adding to the delay. It seems counterintuitive, but speed in this environment can slow down processes.

Finding the Right Balance in Outbound Speed

The ideal outbound speed delivers 100 notes and stops.

The teller can grab and strap and by the time he is finished, another stack of notes is delivered and ready for strapping. The right speed, accuracy, low rejection rates, simplified virtual escrow and short bill path are all factors to be considered when determining to best cash recycler for your environment.

Banknote Recognition – How Does it Work?

Identifying suspect notes has become increasingly difficult and manual detection processes aren’t thorough enough for financial institutions.

Even diligent tellers may not be able to see or feel the difference in a suspect bill anymore. Extra equipment like desktop bill authenticators and pens add time to a transaction and may not detect well- made fakes. Most desktop currency detectors and pens only detect one feature of a bill. Recyclers use multiple technologies to detect different security features that are manufactured into legitimate currency including:

- UV sensors to detect features such as embedded UV stripes

- IR (infrared) sensors to verify paper density and infrared ink features

- Magnetic sensors that verify authenticity of magnetic ink

Recyclers automate this tedious task and make it easier to identify counterfeit bills so they can be removed from circulation. This capability may not be the most critical feature but it’s one of the things that recyclers can do to speed transactions and reduce risk.

UL vs CEN – What's the Difference?

Well, that depends on where you are in the world.

Understanding UL and CEN Standards

UL and CEN are organizations that develop and maintain standards for the physical and environmental safety of a wide range of products.

Underwriters Laboratories (UL) is an independent safety consulting and certification company based in the United States.

The European Committee for Standardization (CEN) provides a unified standards platform for the national standardization bodies of 33 European countries.

Both organizations are widely trusted—by the public and insurance underwriters alike—to validate that certified products meet specific safety and performance expectations.

How Cash Recyclers Are Classified

Cash recyclers are considered burglary protection products, grouped with locks and safes. When a recycler receives certification from UL or CEN, it means the device has passed rigorous testing to verify its resistance to theft, fire, and adverse environmental conditions.

UL291: U.S. Standard for Recyclers

The UL291 standard applies to equipment like ATMs and cash recyclers. It ensures that devices offer a baseline level of protection against both currency theft and unauthorized changes to transaction records.

Within UL291, devices are further classified:

- Business Hours: Intended for operation under supervision.

- 24-Hour (Level 1): Designed to offer protection even without supervision.

Level 1 devices feature thicker metal construction and can withstand physical attacks for a longer duration, offering a higher level of security.

CEN Ratings: A European Approach to Security

The CEN standard addresses the same core areas as UL—fire resistance, theft protection, and structural integrity—but uses a more detailed grading system.

To assess break-in resistance, CEN applies a formula that factors in:

- Partial or complete access

- Tool types and tool values

- Time to breach

- Tool coefficients

The result is a resistance rating expressed as a grade from 0 to VII, with higher numbers indicating stronger protection.

Alarms – Similitude with Security

What’s Guarding Your Safe? Without alarms even the strongest safes are vulnerable to attack. Below are four of the most common alarms found in today’s cash recyclers:

- Thermal Alarm If the internal safe temperature exceeds a certain level an alarm is triggered. Defends against attacks from blowtorch, heat cutting device, etc.

- Door Contact Alarm The alarm is activated if the door is opened without authorization. Protects against internal and external threat.

- Seismic Alarm An alarm sounds if a mechanical vibration is detected. Example: rope and tow, hammer drill, sledgehammer, etc.

- Duress Alarm A pre-programmed “alarm code” allows the operator to manually trigger a silent alarm if faced with a threat. Gives tellers a safe and discrete way to respond to a robbery.

Locks – Another Layer of Security

The safe portion of a cash recycler must meet certain security requirements to comply with regulations for banks and other financial institutions. One of those requirements is that the safe is secured with a lock.

Ideally, the lock should also carry the same security agency certifications (UL or CEN for instance) as the safe.

There are a variety of lock models and features to consider with varying levels of sophistication and price.

Some combine the use of lock hardware and systems software to program, manage and even audit the lock. But what do these lock features mean?

It helps to understand the features so you can determine which features are important for your environment and processes.

Glossary of terms you’ll encounter when selecting a safe lock:

- Single user access - only one user code is required to open the lock. Multiple user access – allows multiple users to be added to the lock, each with a unique code.

- Manager or supervisor mode – a single manager code for a designated Manager user to change lock settings, manage other users and audit the lock.

- Dual mode or dual code – requires two different codes (users) to open the safe and the two combinations must be correctly and consecutively entered to open the lock.

- User override – allows the manager to override any user’s access.

- One-time code – allows a unique, onetime code to be issued to users like service technicians and CIT personnel.

- Wrong combination penalty – more than a few consecutive invalid combinations disables the lock for a specific period of time.

- Time delay – allows the lock to be programmed to delay opening for certain period of time after a valid combination is entered. This period is followed by a programmed open window.

- Open window – defines the amount of time in which a valid code can be entered to open the safe following a time delay.

- Audit trail – record of all lock activity (usually limited to a specific number of events). The audit record cannot be deleted.

- Silent alarm – usually operates by sending a silent signal to an alarm system and is triggered by entering a specific code designated for the alarm.

- Lock disable – allows a code to be entered which disables the lock completely until it is enabled again.

Onboard Operator Display – Yes or No?

One last feature to consider is an onboard operator display.

Most modern recycler models are equipped with touch screens and intuitive graphical interfaces. These allow operators to:

- Perform offline cash operations

- Adjust device settings

- View real-time cash inventory

- Monitor device health and status

Advanced models may also support:

- Reviewing event logs

- Firmware updates for new currency codes

- Temporarily disabling individual cassettes without taking the whole unit offline

Security Considerations with Visible Screens

One downside to onboard displays is the potential exposure of sensitive information. If the screen is visible to customers—especially in open branch designs—there’s a risk of revealing cash inventory or operational data.

Diagnostic Support and Reduced Downtime

A major advantage of onboard displays is built-in diagnostic functionality. These displays can show:

- The exact location of a jam or error

- Step-by-step instructions or videos for quick resolution

This enables operators to troubleshoot minor issues themselves, reducing potential downtime. Even when technical support is needed, the display provides helpful context that can improve the accuracy and speed of the resolution process.

Is It Right for You?

Ultimately, the value of an onboard display comes down to your operational preferences and environment. While it may not be essential for every branch, its added functionality can significantly enhance the efficiency, usability, and responsiveness of your cash recycler.

Cash Recyclers & Software Integration – What are the options?

Installing cash recyclers in your branch isn’t just about deciding which model meets your physical and functional needs. It’s also about determining how to integrate cash recyclers into your branch operations. To decide how to assimilate this new technology efficiently, requires a coordinated effort between multiple departments.

There are essentially three choices to consider:

- Directly integrating recyclers with your current core software platform

- Operating cash recyclers in a standalone environment

- Operating cash recyclers using application middleware

Educating yourself on the available integration strategies and carefully comparing and contrasting your options will help you make the right choice. integration strategies and carefully comparing and contrasting your options will help you make the right choice.

There are essentially three integration methods:

- Direct

- Standalone

- Middleware

CASH RECYCLERS & SOFTWARE INTEGRATION

Option 1: Software Direct Integration

Direct integration is frequently touted as the best option for deploying cash recyclers in retail branch environments.

The interface between the hardware and software is hard coded so it’s the most seamless method from a staff perspective. When teller performs a cash transaction, the teller application communicates directly with the recycler.

Tellers operate in their familiar software environment so they can focus on learning the hardware.

Direct integration, in its purest form, means a core teller platform provider, working with the recycler manufacturer, builds machine code into the core platform so it communicates directly with the recycler. This type of direct integration is often very costly, proprietary to a manufacturer or application platform, and can limit recycler operations to functionality allowed by the teller application.

Direct integration has expanded to include use of universal or multivendor APIs. An API, in this context, is a packaged set of software protocols that supports the native communication language of all major hardware vendors. Teller platform providers can integrate this package into their existing software, reducing time and resources required to start from scratch.

Most APIs used for cash recyclers are built by third parties and considered “universal”, meaning they are not hardware specific. Once the API has been implemented, a core teller platform can be considered to have a “direct integration” available.

For large enterprises, direct integration is an extremely stable and scalable solution since the code is written once and distributed throughout the branch network.

PROS

- Eliminates double keying with no intermediate application between teller and device

- Supported by core system and device supported/certified by the teller application provider

- Often lower costs in licenses and fees for enterprise rollouts

- Minimal disruption to current teller workflow

CONS

- A universal API can limit recycler performance and capabilities

- Code development is expensive and subject to long lead times

- Costly for core system – application provider has limited incentive to “certify” devices

- Support can be confusing relative to root cause – hardware or software issue?

CASH RECYCLERS & SOFTWARE INTEGRATION

Option 2 : Software Standalone Application

Standalone implementations leverage a locally installed software application to operate the recycler independent of the teller application.

Tellers toggle between the two applications on their desktop (often employing shortcut keys).

This requires them to key transaction amounts in both the standalone application and the teller application (double keying). The challenges of implementing a large number of standalone devices make scalability difficult.

PROS

- No costly development work or application customization

- Highly stable with applications designed specifically to support recycler functionality

- Application agnostic solution - not tied to specific teller application

- Simple to train, use and manage exception conditions

CONS

- Double keying creates opportunity for error

- Can be cost-prohibitive for enterprise rollouts

- Generates need to support yet another application in branches

CASH RECYCLERS & SOFTWARE INTEGRATION

Option 3: Software Middleware Application

Middleware (or Soft) integration attempts to address the functionality issues of standalone applications while utilizing recycler features that are often lost in direct integrations.

Much like standalone environments, middleware resides on local PCs, but it is mapped to both recycler and teller software, acting as a translator between the recycler and the teller application.

This eliminates double keying but does add an extra step to balancing.

PROS

- Lower cost due to limited or no need for custom application development

- Eliminates need to double key amounts outside of balancing

- Application agnostic so it protects investment

- Simple to train, use and manage exception conditions

CONS

- Adds a step in balancing allowing opportunity for error

- Enterprise rollout can be cost prohibitive

- Changes to the teller application may threaten stability of “mapping”

- Generates need to support yet another application in branches

How Does Middleware (Soft) Integration Work?

Soft integration uses software to capture cash transaction data from a teller application. The software tool defines the screens and fields in a teller application that contain the cash in and cash out values for deposit and dispense transactions.

The current crop of software tools use a variety of sophisticated OCR and non-OCR technologies to capture the transaction data.

The middleware is then set up to recognize the values in the defined fields and screens to retrieve and send in its commands to the recycler. Once it’s configured, the middleware can operate in the background, translating data between the teller application and the recycler.

CASH RECYCLERS & SOFTWARE INTEGRATION

Insights in Data Capture Technology

Middleware application providers employ various technologies to capture transaction data from teller software.

Optical Character Recognition (OCR) is one such technology. But many people still think OCR means screen scraping. The negative perception attached to the term is something the middleware community is still trying to change

Early middleware providers struggled with immature technology. But modern OCR technologies are far more advanced and bear little resemblance to earlier versions.

Many middleware providers also use other types of data capture. These technologies analyze the data flow between the systems and extract information needed to complete transactions. Proprietary data capture technologies in use are further advancing the field.

But, the perception has been hard to shake. Middleware providers still have to deal with the perception that screen scraping is old technology or simply does not work well. Capturing the data required for completing middleware transactions has come a long way and the negative stereotypes just don’t apply to the modern middleware solutions.

There is no right or wrong answer, there’s only what’s right for you.

By weighing the ease of use, cost, functionality and scalability of each of these options, you’ll choose the right integration method for your unique environment.

How Cash Recyclers Reshape Branch Operations

Recyclers improve the efficiency of nearly every cash process in the branch. But what do more efficient processes really translate to? Time.

More time to spend on high-value activities like customer engagement, building trust and cross-selling. And less time on the tedious, low-value work of cash handling and custodial dual control activities.

How much time, exactly? More than 10 hours to be exact.

That’s the how many hours of labor per day can be saved in an average branch by automating cash handling processes with teller cash recyclers.

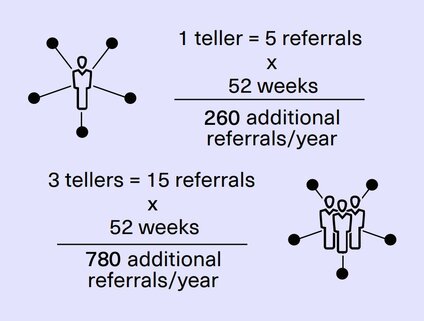

Just how valuable is better customer engagement? It’s conservative to assume, after automation, a teller will be able to refer at least one additional customer per day.

And it’s a safe bet that referral rates will continue to increase as tellers become better sellers.

*dual control activity

How are processes different in an automated branch?

When recyclers replace cash drawers, tellers have a secure vault, right at the teller desk.

Rather than arriving half an hour early to set up cash drawers, start of day procedures are as easy as arriving, starting up the teller software PC, turning on the recycler and serving the first customers.

That saves valuable staffing time and may even eliminate the need to have a head teller on site to open the branch.

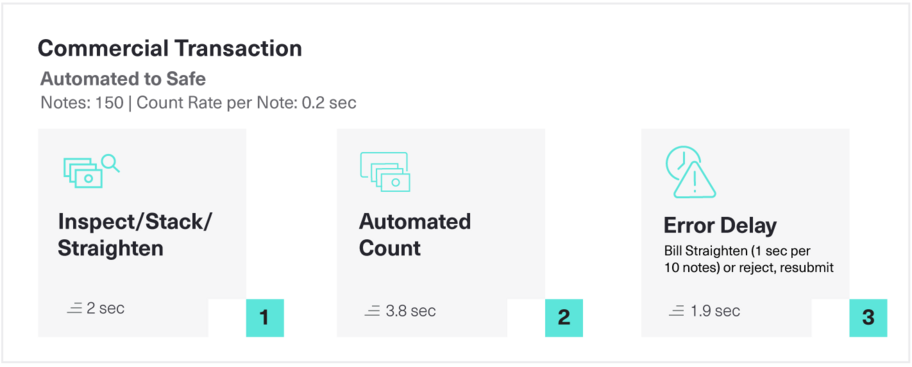

Faster processing for commercial and night drop deposits

Whether the large deposits from retailers and other commercial customers are in the night drop box or happen over the counter during business hours, they slow down the teller line and create longer waits, often at peak times. In a manual branch, a teller must sort, count and verify these large deposits.

But a recycler significantly increases the efficiency and accuracy of these large transactions by automatically sorting, counting, verifying and depositing the bills in a fraction of the time.

Fewer time-consuming vault buys and sells

Vault buys and sells are mundane, low-value transactions that require the largest percentage of time and resources. Recyclers reduce time-consuming vault buys by as much as 80% with cumulative effects.

When recyclers replace cash drawers, tellers don’t manage drawer limits. That means they don’t need to close the line 5 or more times a day when they reach the drawer limit to prepare cash for a vault sell, a process that can take 15 minutes or more.

A vault sell also requires pulling a head teller or manager out of rotation to perform the sell under dual control.

Recyclers also allow tellers to have greater cash inventory securely stored at the workstation resulting in fewer vault buys, another dual control, time-consuming transaction.

When a recycler is used as a shared vault workstation there are still efficiency gains. Tellers may still manage drawer limits and frequent vault buys and sells but there’s a huge difference.

Because the recycler is a secured safe with a electronic transaction journal, the device can act as the second control. This means a individual teller can perform vault buys and sells while meeting security requirements.

Head tellers and managers who aren’t constantly performing dual control transactions are available to assist customers and support branch staff.

Teller focus shifts from the transaction to the customer

The typical cash-handling portion of a transaction takes 20 to 45 seconds. In a manual branch, a deposit looks something like this:

The teller receives the cash from the customer then head down for the next 15-40 seconds, proceeds to count, sort and verify the cash, then enter the transaction into the teller software, place it in the drawer and finally resume eye contact with the customer once the transaction is complete. In the last few seconds, the teller may awkwardly try to cross sell another product but the customer is likely ready to move on.

In a cash automated branch, a deposit will look something like this:

The teller receives the cash from the customer, drops it in the recycler and the next 10-45 seconds are spent engaging the customer, looking at their account, talking about other products and building rapport.

Meanwhile, the recycler validates, counts, sorts and processes the deposit. The teller confirms the deposit amount with the customer and the transaction is complete. The customer expresses interest in another type of account the teller just mentioned and the teller either refers the customer to a customer service rep or assists the customer with the new account.

Dispenses see the same transformation, less focus on the transaction allows more focus on the customer. Tellers in automated branches confidently engage customers in new ways without worrying about the accuracy of their transactions.

Faster Teller balancing and end of day procedures

Recyclers virtually eliminate the balancing issues of cash drawers by removing human error and processing transactions accurately throughout the day.

Tellers are able to help customers up to the last minute, quickly balance their machine, sign off and leave within minutes of closing time.

Vault drawer sells are eliminated because the cash is securely stored in the recycler and ready for the next day. Vault managers only need to verify recyclers are balanced. Imbalances and cash lost to miscounts and error are no longer a problem and internal theft is reduced because all the cash is tracked at the time of transaction.

More effective cross selling

In a manual environment, tellers live under the constant fear of being out of balance. This pressure drives some unintended consequences. Tellers constantly “fiddle” with their cash drawers during the day, moving money back and forth from their top drawer to the second drawer, performing trial balance counts, strapping and counting money, just to maintain control of their cash drawer.

Because they must perform every transaction perfectly and quickly tellers may resist additional pressure to cross sell, citing that they can’t take their focus off of counting cash. Consequently, cross selling initiatives have failed partly because tellers wait until they finish counting the cash before they switch their focus to the customer.

However, while the customer is waiting for a transaction to process, the teller has their complete attention. Being able to engage with customers during each transaction leads to higher referral rates and higher cross selling revenue.

Fewer vault and teller audits

Audits are still necessary for regulatory compliance but are less frequent and less painful with recyclers. Recyclers meet more stringent standards like reduced cash exposure so audits aren’t required as often. Recyclers assist audits by keeping a complete audit trail for every transaction and staff member who touches cash.

Better cash inventory management

Managing the vault is more than just vault buys and sells. It’s also balancing the vault and managing the total cash inventory in the branch. Recyclers capture important data about cash usage. Using this data, institutions can more accurately estimate cash volumes and denomination needs. This reduces costs related to maintaining cash inventory like cross shipments and cash ordering fees. Branches can reduce cash inventory expenses by 15%-40%.

Recyclers even improve the efficiency of cash deliveries. A recycler can count cash deliveries from cash in transit companies and process that inventory directly into the recyclers. By eliminating the need for two people to count and recount cash whenever it changes hands, branches become more efficient in their staffing models and can more easily comply with security policies that control the way exposed cash is handled and moved.

Improved customer service

To win and retain customers, banks must build a very high level of trust strive to be an important financial resource for their customers. To build that trust, banks must engage customers while providing convenience and accuracy. Customers aren’t visiting branches as often, so when they do, it’s important to engage them in a meaningful way. But speed and accuracy also have a direct effect on customer satisfaction. When a recycler automates the cash portion of a transaction, customers will notice tellers are focused on how to help them rather than how to process the transaction.

More efficient staff scheduling

When internal processes are streamlined, managers can schedule only the staff they need to serve customers not the staff needed for customers AND internal processes. With fewer dual custody transactions, head tellers are available to jump in during peak periods and support tellers on the line. Recyclers usually mean you can operate effectively with fewer tellers. Or you can crosstrain and develop your staff to be able perform different processes throughout the branch.

By automating the deposit, validation, denominational sorting, storage and dispensing of cash with a cash recycler, significant savings in both time and money can be realized.

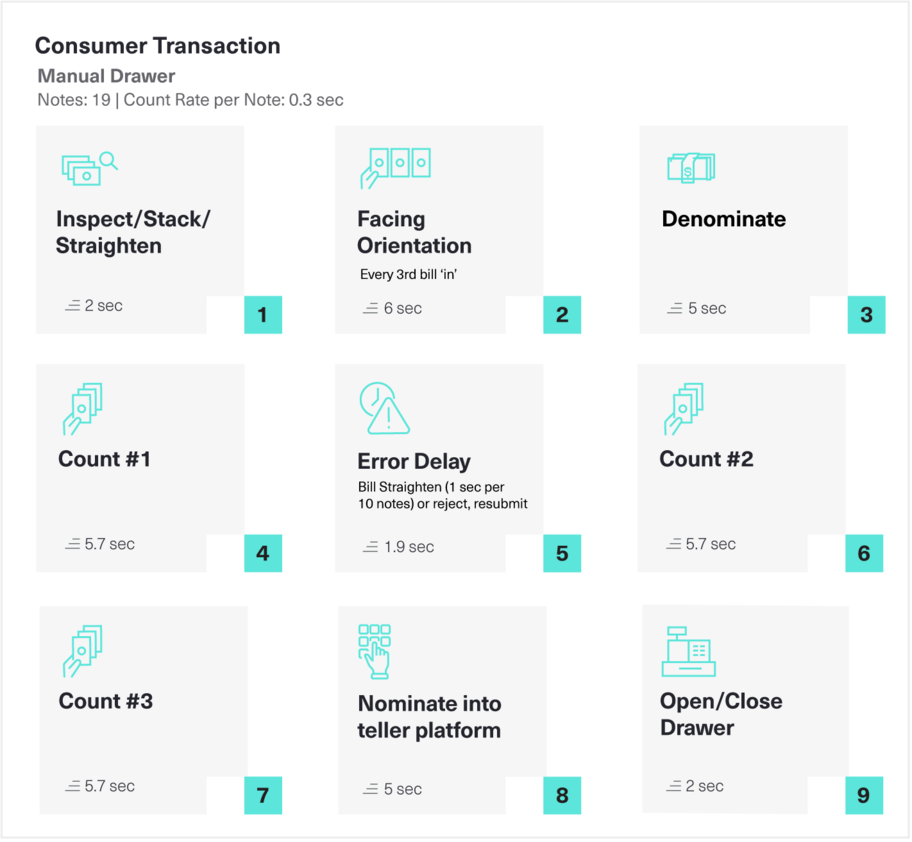

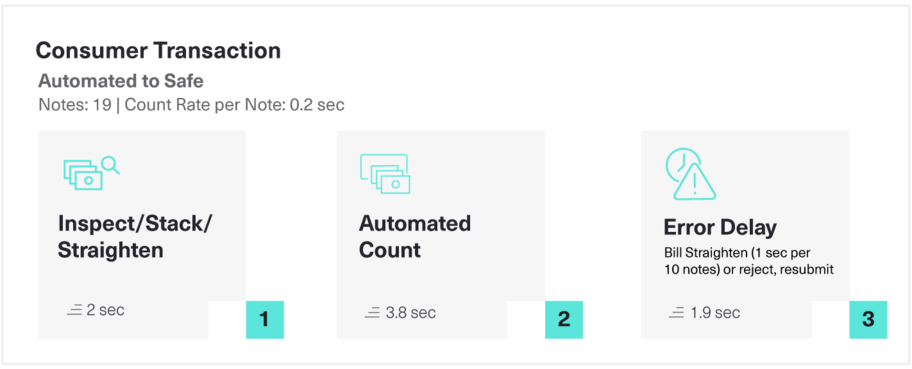

Understanding the Flow: Consumer Cash Deposit Analysis

Manual vs Automated

We examined the cash-in processes for personal (consumer) and commercial accounts at hundreds of banks in North America. We used stopwatches to time transactions, took detailed notes on the steps, and thoroughly interviewed bank tellers on their internal bank processes. The results for commercial deposit processes are summarized on the following pages.

Difference

9 steps | 0:39.0

3 steps | 0:07.7

Time Savings with Automation

00.31.3

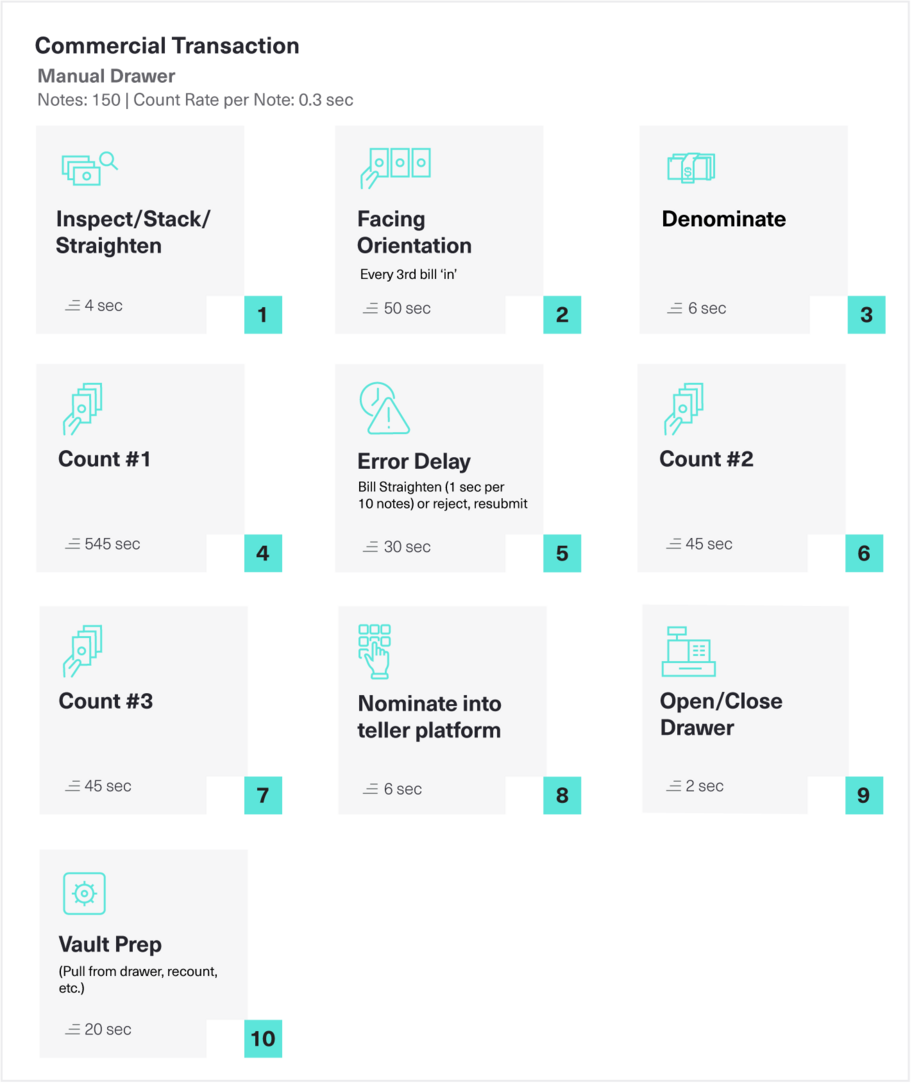

Understanding The Flow: Commercial Cash Deposit Analysis

Manual vs Automated

We examined the cash-in processes for personal (consumer) and commercial accounts at hundreds of banks in North America. We used stopwatches to time transactions, took detailed notes on the steps, and thoroughly interviewed bank tellers on their internal bank processes. The results for commercial deposit processes are summarized on the following pages.

Difference

10 steps | 4:13.0

3 steps | 0:49.0

Time Savings with Automation

03:24.0

A Successful Cash Recycler Installation

A successful cash recycler installation goes beyond plugging in hardware—it aligns people, processes, and space to deliver lasting operational and customer experience improvements. Here's what that looks like in practice.

The vendor and the customer agree on a plan

The key to a successful implementation is the prep work…. detailed planning. Your Installations team should review all of the details with you in advance.

They should ask you things like:

- What’s the closest entrance to here the recycler will be placed?

- Where is the best place to park?

- Where will the machines be placed?

- What type of flooring do you have?

- Will your counters or workstations require any physical alterations?

- Will your teller application company be on site during the installation?

With these details, the actual installation should go quite well.

The install is scheduled during a slow period

Choose a start time that allows the more disruptive work to be completed before the branch lobby opens. While the installation itself isn’t especially noisy, the presence of several additional people can affect branch flow.

Installations typically take between 45 minutes and 3 hours, depending on factors such as location, space constraints, and the number of machines being installed.

The installation is carefully reviewed

Once installation is complete, the crew should:

- Clean up all packing materials

- Conduct basic hardware training

- Complete and review a checklist with you

This final step is your opportunity to walk through the install process, ensure everything meets your expectations, and raise any concerns before sign-off.

From start to finish, the complete installation can take from as little as 45 minutes up to 3 hours.

Installation Day: Where Planning Pays Off

This is when your detailed preparation truly matters. On installation day, small details can have a big impact. Be ready to provide your recycler vendor and installation team with everything they need—whether it’s worksheets, forms, meeting input, or all of the above.

The more information the team has about your environment and setup, the smoother and more efficient the installation process will be.

What to Expect During Installation Planning

Here are some key items to consider or raise during installation planning. If your install team doesn’t ask about these, don’t hesitate to bring them up:

Delivery & Equipment Logistics

- Know your equipment: Recycler models vary in size and weight. Most will require large equipment (e.g., dollies, lifts) to move them into the building.

- Plan the entry route: Confirm which entrance should be used and verify it’s large enough to accommodate both the recycler and any delivery tools.

- Clear the path: Walk the full path from the entry point to the install location. Make sure it’s free from furniture, tight corners, or other obstructions.

Site Readiness Checklist

- Power access: Confirm electrical outlets are within reach of the recycler’s power cable.

- Cord management: Identify whether any cords may create walking hazards and how you’ll secure them.

- Network connectivity: Ensure a stable and accessible internet connection is available at the install location.

- Permanent flooring: Install flooring before the unit arrives—relocating the recycler later can be complicated.

If Your Site Is Still Under Construction

Planning installation in a building under construction? Schedule delivery only after:

- Electrical and network systems are fully installed and tested

- Most interior finishes are completed

- Access routes are safe and unobstructed

Also, don’t overlook practical details: working bathrooms and break spaces help technicians do their job more comfortably—especially if they’ll be onsite for a full day or longer.

Branch Readiness Checklist: Preparing for a Smooth Cash Recycler Installation

Work Area

If recyclers are going under existing counters, do any modifications need to be made for them to fit? And do the technicians have enough room to access connections and function during the installation process? Workstations and counters should be cleared and cleaned where the accessories need to go. (CC5000, Printer, Coin Dispenser, etc.)

Dedicated Branch Contact

Typically, the branch manager or a project manager, there should be someone who has communicated with the install team and knows what’s going on. The vendor installation team will need a reliable, informed contact in case any issues arise.

Coordinate with IT

Don’t forget the IT department, during the planning and installation process. Ideally, PCs that will be connected to recyclers should have the teller app loaded before installation. If the PCs are ready to go, you’ll save a lot of time during the install and integration.

Decide if you’ll need an IT person from your institution on site for the installation day. Having IT at the ready can be invaluable for any connection issues or just to assist with logins and software admin rights.

Training

Usually the vendor installation technician will train employees to operate the recycler(s) as part of installation process. The staff designated to learn the equipment and train others should be really engaged in the training. Hands on training experience is ideal and taking notes is important as there is a lot to cover in a short amount of time. The more closely you work with your vendor’s installation team, the more smoothly installation and setup will go.

SESAMI INSIGHT INTERVIEW

Inside Global Security: An Interview with Former Wells Fargo EVP Michael Bacon

Michael Bacon is a 27 year veteran of the corporate world of risk management, audit, fraud, security, HR, and investigations. As Founder and Managing Partner of Rezolvrizk, Michael provides professional expertise and resources to assist clients in assessing, analyzing, and resolving risk with efficient and effective solutions.

At Wells Fargo, Mr. Bacon served as the Executive Vice President and Chief Security Officer leading 10 divisions collectively responsible for security and internal investigations at over 10,000 locations across the U.S. and in 36 other countries. Prior to Wells Fargo, he served in a variety of capacities and leadership positions for thirteen years at Bank of America.

He is a vetted member of the International Association of Professional Security Consultants and the International Association for Healthcare Security & Safety.

Q: How can a bank make their branch less of a target for a robbery?

A: Great question.

First of all, it starts with recognizing the risk—acknowledging that robberies can and do happen. That simple awareness is a critical first step. A lot of banks become complacent if they haven’t experienced a robbery recently or ever. But the absence of incidents doesn't mean the absence of risk.

Second, it’s important to understand the specific risk. We often conduct risk assessments to help banks benchmark themselves against other institutions in their area. Look at what peer banks and credit unions are doing. Have they been robbed? Are there recent incidents in your city or town? Use that information to understand your exposure.

Third, banks need to take action. That includes ensuring their security equipment is operational—not necessarily the newest, but effective. Ask:

- Does your video system provide clear images?

- Do your alarm systems function properly?

And lastly—arguably most important—is staff training. Employees should know how to:

- Identify suspicious behavior

- Respond appropriately to concerning activity

- React effectively during and after a robbery

All three—awareness, benchmarking, and preparedness—are key to reducing the risk of becoming a target.

Q: How do non-traditional branch designs affect branch security?

A: There’s an interesting challenge with cash recyclers. This is an interesting device, a great device.

But to think we have branches now that are technically cashless without manual drawers is an interesting concept.

There’s an upside to it, and I can touch on that from an embezzlement standpoint. It certainly nearly eliminates the risk for embezzlement.

But on the other side it’s created, at least for some of our clients, the question of how do you react in a bank robbery setting? In all of the new designs people are in closer contact with fewer physical barriers. That in itself is a different type of training.

Also, robbers are not used to recyclers yet, there not being a cash drawer. So in case of a robbery, you have to plan for:

- How much money do we dispense to give to the individual?

- How much is enough?

- Are employees trained at knowing how to dispense the fake money, if you will?

So just different applications, very similar to traditional bank security and bank security training, but there’s going to be different scenarios and we’ve got to prepare for that and train for that.

Q: Are process changes an important factor when introducing new technology into a branch?

A: Absolutely. I’m a security professional, and we’re all about reoccurring risk assessments and as conditions change, you too must reassess your risk.

If hours change, that could pose a different risk.If your customer base changes, that could pose a risk. Anything from a redesign or a remodel is fairly drastic change and as you’re alluding to, some of the transformation of these branches, definitely requires a step back and a reassessment.

Ensuring that we revisit and look at our security procedures, our policies and our equipment and our training approaches to make sure that they address any risk that we see in this new, transformed branch.

Something I don’t really touch on very often when we talk about cash recyclers is internal theft.

I’m in the prevention business. I want to take all of my experience and try to bring safer, more secure, more ethical environments to banks and to credit unions.

With internal fraud, it’s not just the embezzlement, it’s the loss of an employee. It’s the cost of hiring and then losing an employee around an criminal action. Then the process of hiring, replacing and training that individual. So embezzlement is a costly event from a financial and personnel perspective.

The loss of an employee for misconduct is quite impactful as well. It’s a coworker, a friend, somebody you trusted.

So if we can prevent this activity, break the cycle and the opportunity, it's a huge win for any financial institution.

Post Installation Follow Up: What Now?

Installation is only the beginning. A strong follow-up plan ensures your cash recycler delivers long-term value—through proper training, system checks, and ongoing support.

Hardware & Software Training

Your recycler vendor should provide services to install, test, integrate and train your staff to use your new recycler(s) in your environment.

Equipment Testing & Verification

Once the recycler(s) are installed on site, the installation technician will run them through extensive tests to verify the equipment is 100% functional. At the end of the installation, the unit(s) will be verified as fully functional and ready to use.

Integration with Your Environment

The technician will also integrate the recycler(s) into your existing setup. This includes configuring network connections and linking the equipment to your teller software—regardless of the integration method you choose.

Defining New Procedures

With recyclers automating many of your manual cash procedures, you’ll need to work with your installation technician to evaluate processes and correlate them to the cash management software and recycler features. New procedures will be developed around the accuracy, efficiency and security impacts of automating manual cash processes. Typically, new procedures will be reviewed with users and management, and then documented.

Teller Training

Once integration is complete, your staff will receive hands-on training using the actual teller software and installed recycler units.

Hardware training includes:

- Performing offline cash transactions

- Start-up and shutdown procedures

- Identifying and correcting hardware errors

- Basic troubleshooting

Software training covers tasks such as:

- Dispense and deposit transactions

- End-of-day balancing

Thorough training continues until staff demonstrate proficiency in the new procedures. At the end of the session, your vendor should provide guides and reference materials to support continued learning and help train additional team members.

Plan for Hardware Cleaning

Just like anything else, a recycler can collect dust and debris from the air, carpeting and cash itself. Dirt and oils from all those bills can build up on sensors and belts over time and affect how accurately a sensor reads or how well a belt moves.

A lot of problems like misfeeds and jams are caused by dirt buildup and can be prevented with regular cleaning. Your recycler should include a cleaning kit with the tools to make the job quick and easy. These tools are designed to get to hard to- reach areas and include items like lint-free cloths and cleaning solutions that are safe to use on parts such as photo sensors and rollers. Your installation technician can recommend a cleaning schedule, show you how to use your cleaning tools and how to order more.

Cross Training Employees

Cross training isn’t really part of recycler installation training, but it’s definitely a pleasant side effect.

Once your staff is proficient in an automated cash environment, there will be time for high-value activities like cross training. Few things are more valuable and efficient than employees who can step into other roles when necessary.

A cross-trained staff allows management to maximize internal resources and realize benefits like more scheduling flexibility and increased employee retention which translates to saving the costs of new hires. And for associates, it can reduce job stress, increase job satisfaction and provide growth opportunities.

Cross-Selling Cash Recyclers: A 101 Cheat Sheet

Cross-selling is one of the most effective ways to boost profitability. The cost of selling to existing customers is far lower than acquiring new ones—and increasing your share of wallet also makes it harder for customers to take their business elsewhere.

With that in mind, many institutions are focusing on how to leverage branch visits for cross-selling. Cash recyclers support this shift by freeing up teller time, allowing for more meaningful customer interaction. But here’s the reality: most tellers won’t become cross-selling experts overnight.

They need the right training—focused on listening, guidance, and solving real customer problems.

1. Identify “Sticky” Products

Start by understanding which products customers truly value and tend to stick with. These are often services that:

- Solve a specific pain point

- Offer time or cost savings

- Are unique to your institution

By focusing on high-value, high-retention products, your team can cross-sell with purpose—and build loyalty in the process.

2. Train for Guidance, Not Just Sales

With routine transactions moving online, branch visits are becoming more advice- and service-driven. Staff should be trained to:

- Listen for customer needs

- Recognize opportunities to help

- Suggest relevant products as solutions

This builds trust and positions your team as financial problem-solvers—not just salespeople.

3. Don’t Forget to Ask for the Sale

Trust and loyalty matter—but sales still require action. Research shows that nearly one-third of all banking products are sold, not bought.

Whether in conversation or through targeted materials, your team must be comfortable and confident in asking customers to take the next step.

What Does a Cash Recycler Cost?

Pressure to control operating costs and enhance teller functionality has led many financial institutions to consider implementing teller cash recyclers in their branches.

Calculating ROI: Why It’s More Than Just Math

In as much as no two branches are alike, there isn’t a one-size-fits-all method for evaluating solution configuration and therefore price.

What follows is an outline of the pricing elements worth considering when examining your teller cash recycler investment.

Hardware Costs

The advancement of TCR technology has led to a broader range of configurations and features, making them more accessible and adaptable. This progress has resulted in a wider array of options and more tailored solutions to meet specific branch requirements

Configuring recyclers to meet the unique needs of individual branches requires analyzing branch data around transactions, cash volume, staffing, and security.

It is crucial to conduct an in-depth branch analysis to determine the correct recycler model and configuration.

Depending on the recycler’s features (and quality), you’ll find a wide range of prices between brands.

Integration Costs

Integration is the “secret sauce” of teller cash recycler adoption. At the end of the day, the method leveraged to integrate hardware with your teller application will have a significant impact on productivity gains, teller adoption and overall return on investment.

There are three basic approaches - standalone, middleware (soft integration) and direct integration. Each boasts pros and cons worthy of further consideration.

Installation and Training Costs

Ensuring effective adoption of teller cash recyclers is largely dependent on robust user training. Cutting corners to save on training undercuts the inherent value found in the hardware and integration elements of the overall solution.

Be certain your selected vendor is a teller cash recycler expert, capable of not only teaching staff how to use the recycler in ideal conditions but also preparing them to recover from exceptional conditions. The importance of proper training cannot be stressed enough.

Onsite Service and Preventative Maintenance Costs

Realizing maximum return from investment in cash recyclers requires partnership with capable service providers.

Cash can be dirty and difficult to manage. To protect and optimize your investment, it’s a good idea to work with an organization that has significant tech coverage and a plan for proactive preventative maintenance based on device throughput.

Cutting back on service investment is yet another way many organizations fail to attain expected results from recycler adoption. It’s important to research response time, preventative maintenance procedures, and remote monitoring capabilities thoroughly.

Calculating the total cost of a cash recycler implementation is a key component of the decision making process.

Taking the time to understand your branch requirements as well as the available options in the market will lead to an informed decision.