Cash Management in Retail: The Complete Guide

Learn how cash automation improves retail efficiency, reduces overhead, and supports smarter financial operations.

The Ongoing Relevance of Cash in Retail

Despite the growing adoption of mobile wallets and card-based payments, cash continues to be a widely used payment method, particularly in brick-and-mortar retail environments.

According to the Worldpay Global Payments Report, cash is expected to represent approximately 10% of global point-of-sale (POS) transactions by 2025.¹

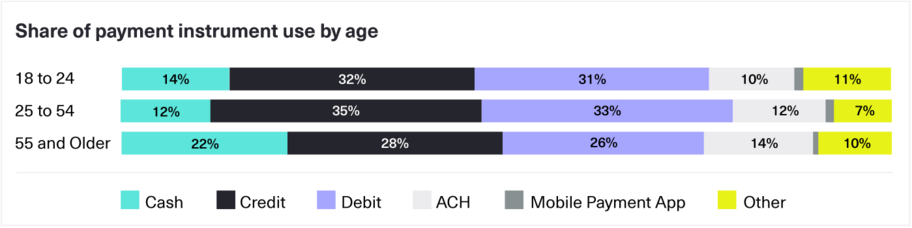

Although this marks a decline compared to previous years, cash remains essential—especially among key consumer segments such as individuals aged 55 and older, who consistently demonstrate a strong preference for using cash.

The Hidden Costs of Manual Cash Handling

Retailers continue to face major challenges associated with manual cash management, including:

- Time-consuming processes at the checkout and in back-office operations

- Cash shrinkage, both accidental and deliberate

- Theft and robbery, impacting store profitability and employee safety

- Operational inefficiencies in daily cash flow reconciliation and deposit preparation

For retail business owners and store managers, improving cash security and optimizing cash logistics is more important than ever.

Rethinking Cash Handling: The Role of Automation

How can retailers reduce their exposure to risk, improve staff safety, and streamline cash-related tasks? The answer lies in automated cash handling technologies—solutions that are increasingly critical in today’s retail ecosystem.

This guide explores how automated cash management systems help:

- Reduce cash handling time and free up staff for customer service

- Minimize losses caused by internal errors or external theft

- Improve cash visibility and reconciliation accuracy

- Strengthen retail security in both front-of-house and back-office operations

- Drive operational efficiency across single and multi-store retail networks

Efficiency, Savings, and Better Customer Experiences

By implementing the right cash automation technology, retailers can expect measurable outcomes: lower operating costs, fewer errors, improved employee satisfaction, and ultimately, a better customer experience at the point of sale.

Retailers who modernize their cash handling infrastructure stand to gain not only operational improvements but also a competitive edge in an increasingly digital yet cash-inclusive retail landscape.

¹ Worldpay from FIS. (2022). Global Payments Report.

The Retail Future? Cash is Here to Stay

Despite the growing adoption of digital payment methods, cash continues to play a significant role in the U.S. economy. While the use of cash has declined in recent years, it remains a widely used and accepted form of payment, particularly for smaller transactions and among older demographics.

According to the Federal Reserve, the amount of cash in circulation has consistently increased year over year since 1999.

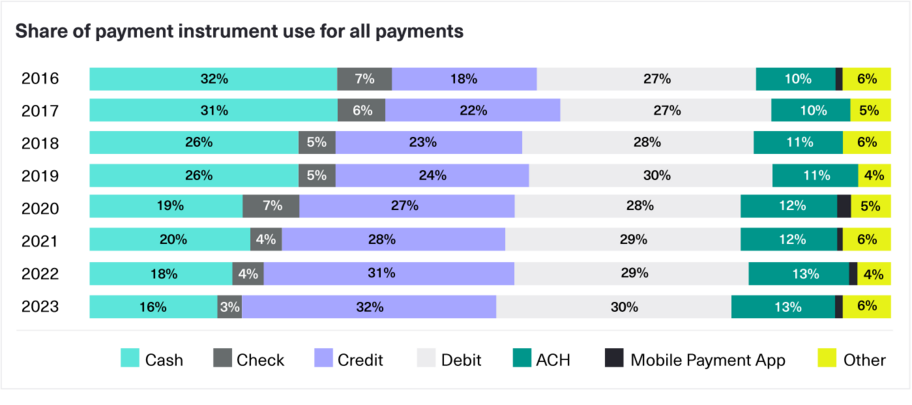

In 2023, the most recent year for which Federal Reserve payment data is available, cash was used in 16% of all payment transactions. While this represents a slight decline compared to previous years, the change is largely attributed to an overall increase in the total number of payments—not a drop in cash usage itself.

This trend suggests that although cash’s share of transactions may decline as digital payments grow, there remains a stable, underlying demand for cash. This demand is likely driven by factors such as:

- Consumer preference (especially among older demographics)

- Accessibility in unbanked or underbanked populations

- The unique advantages of cash, including anonymity, immediacy, and control over spending

Cash continues to play a vital role in the payment landscape, particularly within retail environments where flexibility and inclusivity are essential.

The impact of COVID-19 on cash usage has been mixed.

While there were initial concerns that the pandemic would accelerate a shift towards a cashless society, data shows that many Americans continue to rely on cash.

In fact, the amount of cash people carry increased during the pandemic, indicating a continued trust in physical currency during uncertain times.

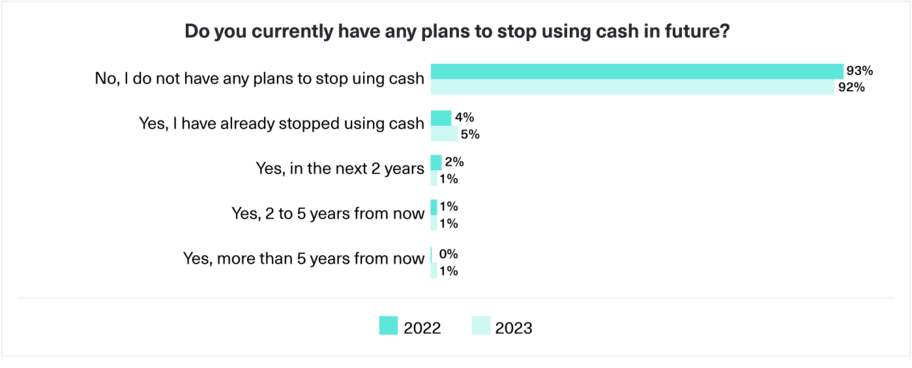

More than 90% of people plan to keep using cash, either for payments or as a store of value, due to its unique advantages.

Defining The Cash Process in Retail

Retailers must optimize cash handling while managing an increasingly digital payment mix. In order to manage the cash, staff must perform several tasks throughout the day.

This daily routine requires precision, time, and coordination—especially in high-traffic retail environments. From opening to closing, each step in the cash handling process plays a role in maintaining operational control and minimizing risk.

- Validate and count cash into drawers at the start of their shift

- Handle cash during customer transactions, while also greeting and assisting customers

- Refill or swap out denominations in register drawers

- Remove excess cash and bring it to a back office

- Deliver deposits to a cash office or the bank

- Perform end-of-shift reconciliation, with both cashiers and managers counting the drawer to confirm totals

A Day in the Life of Retail Cash Handling

From opening to close, a typical retail shift involves constant interaction with cash, requiring precision, accountability, and time.

Start the day

1. Preparing the Float

Cashiers count and set up a mix of notes and coins in their cash drawers at the start of their shift.

2. Payment Management

Throughout the day, cashiers accept payments, make change, and assist customers.

During the day

3. Cash Drawer Refill

When small denominations run low, cashiers pause to restock from the back office—causing register downtime.

4. Cash Skimming

Excess cash or large bills are removed from drawers and placed in a secure drop safe.

End of day

5. Reconciliation

At shift end, cashiers count and verify the drawer total. Funds are secured in a safe or sent to the cash office.

6. Cash Transport to Bank

Rather than going in person, most retailers rely on armored cash pickup services for bank deposits.

Knowing Your Retail Cash Management Risks

While handling cash is part of daily retail operations, it also introduces a range of risks that can impact security, accuracy, and profitability. To build a resilient cash process, it's important to first understand the key vulnerabilities.

Time and Labor Costs

For retailers, having to manually count cash, replenish cash drawers, perform daily reconciliations, balance cash drawers and prepare cash for transportation cost time and money. Administration alone, including the time spent on cash reconciliation, can represent over 70% of cash management costs. As a result, efficiency declines and customer engagement is set aside.

Security Risks

Theft and robbery remain major threats in retail. According to the 35th Annual Retail Theft Survey by Jack L. Hayes International:

- Nearly 45,000 dishonest employees were apprehended in 2022, an 18% increase year-over-year

- Over $50 million was recovered from employee theft, up 14.7% from the previous year

Additionally, the U.S. Chamber of Commerce reported that Organized Retail Crime (ORC) cost retailers over $700,000 per $1 billion in sales in 2020—marking a 50% increase over five years.

Shrinkage

Shrinkage—loss of inventory or cash due to theft, skimming, or human error—is at record highs. The National Retail Federation reported:

- Retail shrink hit $112 billion in 2022, up from $93.9 billion in 2021

- Causes include employee theft, shoplifting, register errors, and administrative mistakes

Manual cash handling makes it difficult to trace and correct these issues, increasing exposure to financial loss.

Lack of Cash Visibility and Control

Cash management is all about visibility and control. Knowing how much money you’re dealing with each day at each store location and where that money is going is key to successful management.

Managing cash levels and cash processes manually costs retailers significant amounts of time and money.

How Retailers Benefit from Cash Automation

Automated cash handling systems are transforming how retailers manage cash by streamlining operations, reducing risk, and improving transparency across store locations.

Increased Operational Efficiency

Automated cash management solutions eliminate many time-consuming manual tasks such as counting, reconciling, and preparing deposits. This streamlines the cash cycle, reduces labor costs, and allows cashiers to focus more on customer service.

Enhanced Security

By limiting physical access to cash through secure, certified safes and controlled processes, automated systems reduce the risk of theft and robbery. This creates a safer environment for employees and reassures business owners that protective measures are in place.

Loss Prevention

Smart cash handling technologies significantly reduce shrinkage by increasing visibility into every transaction. Deposits are automatically tracked and registered by cashier and shift, helping prevent internal theft and minimize discrepancies.

Optimized Cash Cycle Monitoring

Integrated solutions combining hardware, software, and services provide complete oversight of cash operations. Advanced tracking and reporting tools offer real-time visibility across all store locations, improving accountability and enabling data-driven decision-making.

Automated Cash Handling Systems for Modern Retail

There are several automated cash management options available to retailers. Understanding the functionalities of each will help you decide which ones will best meet your cash processing needs.

Closed Cash Handling System

Closed cash handling systems secure cash from the moment it is accepted at the point of sale until it is picked up by a cash transport service. These systems are fully integrated into the store’s front-end and back-office workflows.

Key components typically include:

- Payment station at checkout: Accepts and recycles notes and coins, dispensing change and storing high-denomination bills in locked cassettes

- Sealed transport cassette: Secure and often ink-protected, this cassette is used to transfer cash safely to the back office

- Back-office deposit safe: Receives the cassette and secures the cash until it is collected by a pickup servic

This system reduces cash exposure, increases staff safety, and helps prevent theft and tampering.

Cash Deposit Systems

Smart safes, or cash deposit systems, validate, count, and log every deposit made by store staff. These units generate detailed audit trails and improve accountability while saving time spent on manual cash handling.

Key features include:

- Real-time monitoring of cash levels via bank and cash pickup service integrations

- Provisional credit capabilities: Retailers may receive bank credit for deposits even before physical pickup

- Scalable formats for different retail sizes:

- Compact under-counter models for checkout use and lower cash volumes

- High-speed, high-capacity models ideal for back-office environments

Smart safes provide faster access to working capital, reduce deposit frequency, and improve visibility into store-level cash flow

Retail Cash Automation: Unified Systems and Software Platforms

In today’s fast-paced retail environment, the combination of automated systems and smart software is essential for efficient, secure, and scalable cash management. These technologies work together to reduce manual handling, improve visibility, and streamline operations across front-end and back-office processes.

Cash Recyclers

Cash recyclers automate both cash acceptance and dispensing within a secure, certified system. Often referred to as a virtual vault, they count, validate, store, and recycle cash throughout the day, minimizing the need for manual drawer refills or vault visits.

Key benefits include:

- Morning float preparation: Automatically dispenses notes and coins for cash drawers at the start of the shift

- Real-time recycling: Received cash is re-used during the day, with excess stored securely or sent for deposit

- Drawer refills on demand: Cashiers can restock specific denominations directly from the recycler

- End-of-day reporting: Generates detailed audit logs to simplify reconciliation and reduce back-office labo

Cash Control and Reporting Software

Cash management softwares provide centralized visibility over all cash activities, whether across a single store or multiple locations.

Core features include:

- Real-time tracking of cash levels, deposits, and collections

- Sales reconciliation and reporting integration with POS and banking systems

- Multi-location oversight: Retailers gain a full picture of store-level and enterprise-wide cash positions

- Improved cash flow planning, helping managers optimize float levels and reduce surplus cash on hand

Together, systems and software form a complete cash automation ecosystem that enhances control, improves accuracy, and drives operational efficiency at every level.

Conclusion

Cash remains one of the most popular forms of payment in the U.S., continuing to be a preferred choice among many consumers. Despite the growth of digital payments, the demand for cash remains strong, especially in retail environments.

This ongoing reliance on cash presents retailers with a unique set of operational challenges, including:

- High administrative and labor costs

- Risk of shrinkage, theft, and robbery

- Limited visibility and control over in-store cash levels

To meet these challenges, automating cash handling is a strategic solution. With the right systems in place, retailers can:

- Eliminate manual inefficiencies

- Reduce operational costs

- Enhance store security

- Free up staff to focus on service and sales

Automated cash management systems—such as smart safes, note and coin recyclers, and reporting software—safeguard cash, provide real-time visibility, and enable data-driven decision-making. These tools not only improve accuracy and accountability but also streamline both front-end and back-office operations.

For retailers to fully benefit, it’s essential to assess their specific needs: cash volumes, store layouts, and security risks.

Selecting the right mix of technologies tailored to those needs is key to optimizing performance.

Those who invest in cash automation today are setting the foundation for long-term success—cutting costs, improving efficiency, and creating a safer, more seamless experience for both employees and customers.